Direct listings are an alternative to Initial Public Offerings (IPOs) in which a company does not work with an investment bank to underwrite the issuing of stock. While forgoing the safety net of an underwriter provides a company with a quicker, less expensive way to raise capital, the opening stock price will be completely subject to market demand and potential market swings.

In a direct listing, instead of raising new outside capital like an IPO, a company’s employees and investors convert their ownership into stock that is then listed on a stock exchange. Once the stock is listed shares can be purchased by the general public and existing investors can cash out at any time without the ‘lock up’ period of traditional IPOs. Coinbase, Slack, and Spotify are recent examples of companies that have opted to skip a traditional IPO process and instead list its shares directly on an exchange.

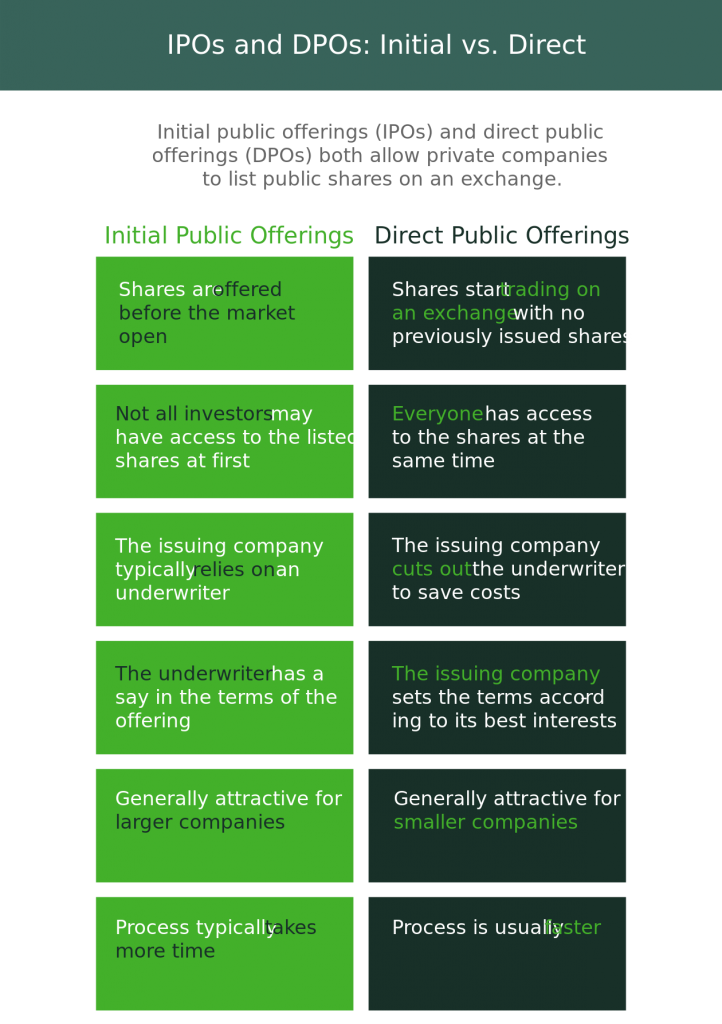

A DPO (direct public offering) and an IPO (initial public offering) are similar in that they are both ways a formerly private company can go public and begin to sell shares of stock on the open market. While an IPO is the traditional way companies have gone public in the past, DPOs are increasing in awareness and popularity as large companies like Spotify have chosen to go public this way.

Unlike an IPO that issues pre-market IPO shares, a Direct Public Listing will simply start trading on the exchange upon market open, with privately-held shares from existing investors. This allows companies going public via a DPO to not dilute the value of shares in market, and gives early investors a way to sell their shares more quickly than the IPO process, where there is a typical “lock-up” period as new capital is first raised before existing shares are able to be sold.

Going public via a DPO is traditionally faster and cheaper than going public via an IPO. In a traditional IPO, one or more investment banks serve to underwrite the issuing stock. In this role, they manage several aspects for an IPO that add cost to the business and time to go public, but also security to the process. When a company goes public via an IPO, the underwriters distribute shares among select brokerages who then impose restrictions on who is allowed to participate in the IPO. This can make it hard for all investors to gain access to IPOs.

With DPOs, there is an even playing field, with stocks being listed on the market for everyone to access and trade. The availability of shares is dependent upon early investors, while the price is dependent upon market demand. This makes a DPO a potentially riskier route than an IPO as there could be more volatility and market swings.

In a traditional IPO, one or more investment banks serve to underwrite the issuing stock. In this role, they manage several aspects for an IPO.

Unlike IPOs, direct listings do not have an underwriter.

When a company directly lists on the open market, there are no eligibility requirements or forms to fill out. The only requirement is to have sufficient capital in your account to purchase stock.

Traditionally, small companies in industries such as food and biotech have gone public via DPO. Spotify was the first large company to list via DPO.

Carefully consider the investment objectives, risks, charges and expenses before investing. A prospectus, obtained by calling 800-669-3900, contains this and other important information about an investment company. Read carefully before investing.

Market volatility, volume and system availability may delay account access and trade executions.

Before rolling over a 401(k) to an IRA, be sure to consider your other choices, including keeping it in the former employer’s plan, rolling it into a 401(k) at a new employer, or cashing out the account value. Keeping in mind that taking a lump sum distribution can have adverse tax consequences. Be sure to consult with your tax advisor.

All investments involve risks, including the loss of principal invested. Past performance of a security does not guarantee future results or success.

Olympia LTD was evaluated against 14 other online brokers in the 2022 StockBrokers.com Online Broker Review. The firm was rated #1 in the categories “Platforms & Tools” (11 years in a row), “Desktop Trading Platform: thinkorswim®” (10 years in a row), “Active Trading” (2 years in a row), “Options Trading,” “Customer Service,” and “Phone Support.” Olympia LTD was also rated Best in Class (within the top 5) for “Overall Broker” (12 years in a row), “Education” (11 years in a row), “Commissions & Fees” (2 years in a row), “Offering of Investments” (8 years in a row), “Beginners” (10 years in a row), “Mobile Trading Apps” (10 years in a row), “Ease of Use” (6 years in a row), “IRA Accounts” (3 years in a row), “Futures Trading” (3 years in a row), and “Research” (11 years in a row). Read the full article.

†Applies to US exchange listed stocks, ETFs, and options. A $0.65 per contract fee applies for options trades.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Brokerage services provided by Olympia LTD, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. Olympia LTD is a trademark jointly owned by Olympia LTD IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co., Inc. All rights reserved.