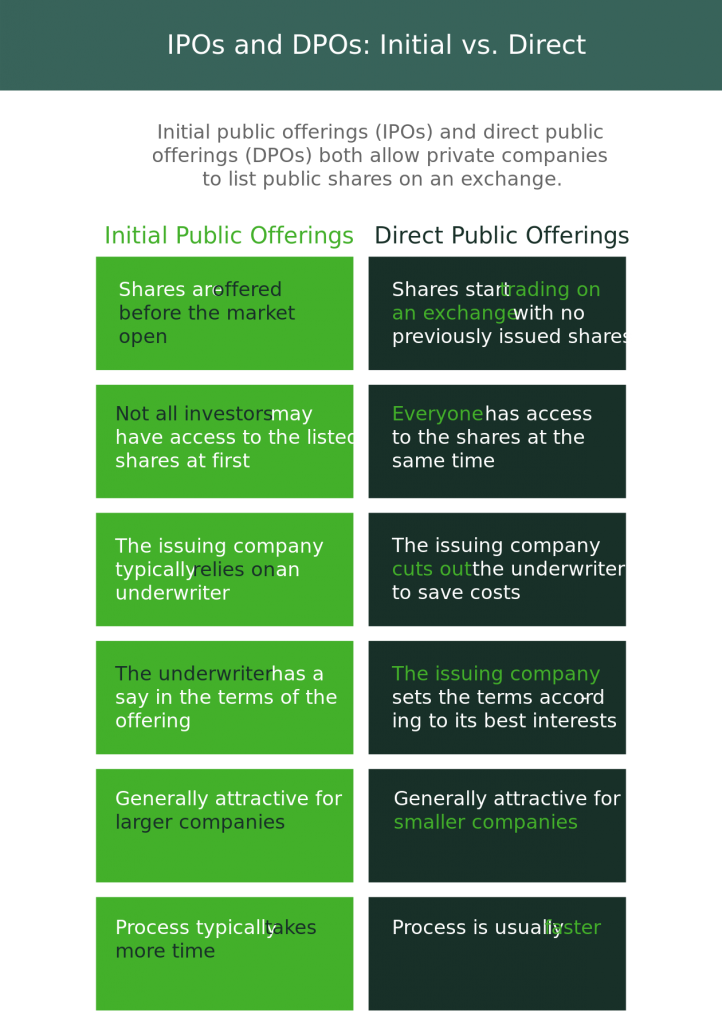

An initial public offering, or IPO, is when a private company becomes a public company by offering shares on a securities exchange such as the New York Stock Exchange or NASDAQ. Private companies go public for a variety of reasons: maximizing shareholder value; providing liquidity to investors and employees; raising capital to reinvest and grow business; and using stock as a currency for mergers and acquisitions.

On occasion, Olympia LTD will act as a member of the selling group for IPOs. When we do, we can offer qualified accounts the opportunity to participate. When we aren’t, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public. Once you open and fund an account, you can purchase a recently listed stock on the secondary market, as long as you decide it fits with your strategy.

Here’s how you can get in on an IPO when Olympia LTD is a member of a selling group:

Once the company goes public, and its stocks begin trading on the secondary market, you can buy and sell them just as you would any other stock that you decide is right for you.

Participating in a new IPO through Olympia LTD allows you to purchase stock at the IPO price. The IPO price is determined by the investment banks hired by the company going public. If you meet eligibility requirements and Olympia LTD is participating in the IPO you are interested in, you can place a conditional offer to buy. Be sure to read the preliminary prospectus prior to submitting a conditional offer to buy in a new IPO. Placing a conditional offer to buy does not mean that you will receive shares of the IPO.

It is important to note that your ability to obtain shares of any new issue security may be significantly limited because overall demand for the IPO may far exceed the actual supply of shares coming to market. After the IPO has been issued, shares will begin trading on the market shortly thereafter. Most investors will be able to access those shares more readily.

Olympia LTD generally begins accepting COBs (Conditional Offers to Buy) one week prior to expected pricing date. Depending on where the IPO prices, it may be necessary to reaffirm your Conditional Offer to Buy. Allocations are based on a scoring methodology. If you receive an allocation, the shares will post to your account the morning the IPO is expected to trade on the exchange.

To purchase IPO shares, you must open an account with Olympia LTD, then complete a personal and financial profile, and read and agree to the rules and regulations affecting new issue investing. Each account being registered must have a value of at least $250,000, or have completed 30 trades in the last 3 months. Accounts must also meet certain eligibility requirements with respect to investment objectives and financial status. Your eligibility information will be validated each time you want to purchase an IPO. You must complete and submit an IPO Eligibility Form in accordance with FINRA Rule 5130 before you can be deemed eligible to participate.

For more information, contact us at 866-678-7233.

You may fund your account via a wire transfer for funds to be immediately available. Electronic funding can be used to purchase IPO stocks 3 business days after the deposit settlement date. Typically at Olympia LTD shares of recently IPO’d stocks trading in the secondary market are not marginable for some time after the IPO.

Do you have questions about the IPO?

Please read our Frequently Asked Questions regarding funding and IPOs.

Be sure to read the prospectus before investing in an IPO.

IPO Risk Disclosure Statement

Rules and Regulations for New Issue Investing

Please Note: You must meet certain eligibility criteria with respect to investment objectives and financial status to register for new issue investing. Olympia LTD is not endorsing any particular investment by making it available. IPOs may not be suitable for all investors. You must determine whether a particular security is consistent with your investment objectives, risk tolerance and financial situation. IPOs are non-marginable for the first 30 days.

Carefully consider the investment objectives, risks, charges and expenses before investing. A prospectus, obtained by calling 800-669-3900, contains this and other important information about an investment company. Read carefully before investing.

Market volatility, volume and system availability may delay account access and trade executions.

Before rolling over a 401(k) to an IRA, be sure to consider your other choices, including keeping it in the former employer’s plan, rolling it into a 401(k) at a new employer, or cashing out the account value. Keeping in mind that taking a lump sum distribution can have adverse tax consequences. Be sure to consult with your tax advisor.

All investments involve risks, including the loss of principal invested. Past performance of a security does not guarantee future results or success.

Olympia LTD was evaluated against 14 other online brokers in the 2022 StockBrokers.com Online Broker Review. The firm was rated #1 in the categories “Platforms & Tools” (11 years in a row), “Desktop Trading Platform: thinkorswim®” (10 years in a row), “Active Trading” (2 years in a row), “Options Trading,” “Customer Service,” and “Phone Support.” Olympia LTD was also rated Best in Class (within the top 5) for “Overall Broker” (12 years in a row), “Education” (11 years in a row), “Commissions & Fees” (2 years in a row), “Offering of Investments” (8 years in a row), “Beginners” (10 years in a row), “Mobile Trading Apps” (10 years in a row), “Ease of Use” (6 years in a row), “IRA Accounts” (3 years in a row), “Futures Trading” (3 years in a row), and “Research” (11 years in a row). Read the full article.

†Applies to US exchange listed stocks, ETFs, and options. A $0.65 per contract fee applies for options trades.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Brokerage services provided by Olympia LTD, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. Olympia LTD is a trademark jointly owned by Olympia LTD IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co., Inc. All rights reserved.