It’s important to note that there are risks of Fully Paid Lending Income

When you successfully enroll* in the program, we’ll manage the lending process automatically and you’ll receive interest based on the demand for your securities in the lending market —with large positions in unique equities often in highest demand. Plus, you’ll retain full ownership of your investments, which means your earnings will continue to perform based on market conditions.

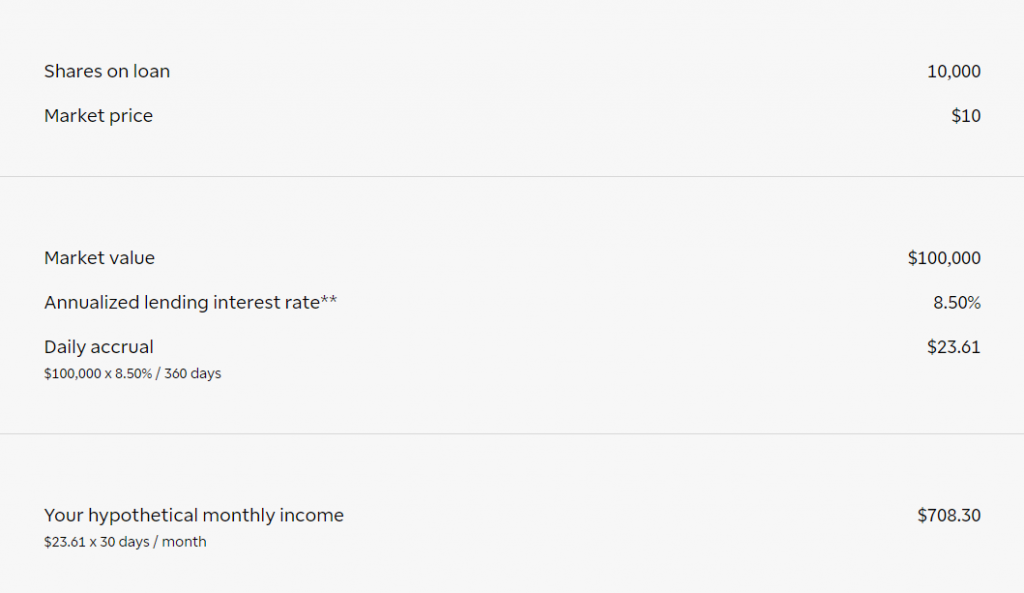

For illustrative purposes only. Past performance is not a guarantee of future results.

Get answers to commonly asked questions about the Fully Paid Lending Income Program.

Olympia LTD’s Fully Paid Lending Income Program provides clients the opportunity to earn extra income from the securities they already own by loaning shares to Olympia LTD while clients maintain full economic ownership. Olympia LTD typically loans the shares to third parties (brokers, traders, hedge funds) for a fee, which is then shared with clients in a 50/50 split.

Currently, only cash and margin IRA accounts are eligible to enroll in the program. All other margin accounts are ineligible at this time. It should also be noted that employer‑sponsored retirement plan accounts like 401(k)s are not eligible under ERISA rules.

Clients may digitally enroll via the Fully Paid Lending Income Enrollment Page or by accessing My Profile > General > Elections & Routing > Fully Paid Lending Income Program > Apply.

Please note: Trust accounts are eligible for the program but cannot enroll online. Please complete the Fully Paid Lending Income Program – Master Securities Lending Agreement and submit via Secure Message Center or fax to Olympia LTD at 866-468-6268.

You are required to meet certain suitability and eligibility requirements prior to acceptance into the Fully Paid Lending Program. Clients will be required to review and acknowledge the Master Agreement prior to enrollment.

No, there are no fees associated with the program. Income received from third parties by Olympia LTD for the shares on loan will be split 50/50 between you and Olympia LTD.

Olympia LTD will charge borrowers for the loan and collect fees that will be shared with the enrolled client in a 50/50 split. Income will be paid on a monthly basis.

Hypothetical income example (based on 360‑day annualized lending rate of 10.5%):

You will be able to see your loaned shares, collateral, and the rate you are earning online daily. Daily statements will reflect the previous day’s loan activity. A monthly statement will also be provided as summary and lending income information.

Daily and monthly statements will only be available if loan activity has taken place and can be found online: My Account > Statements > Fully Paid

Upon enrollment, all fully paid securities will be eligible to loan; however, market demand will drive which securities may be loaned out. Demand and pay rates vary by security and over time.

All enrolled accounts holding the security will be identified and put into a lottery process. Accounts will then be selected on a random basis. Positions under $10,000 may not be considered in the lottery process.

Each security has its own lending rate based on demand.

Yes, you may remain invested and can continue to buy or sell securities as usual. However, once the securities on loan are sold, the loan will terminate and the client will stop receiving loan interest.

Olympia LTD will fully secure loans through the program with FINRA‑approved methods of collateral (cash or U.S. Treasury bills and Treasury notes) that are held at Charles Schwab Trust Company, our third‑party administrator.

Please submit your request by logging in to your account via the web and going to Client Services > Message Center to write us.

Fully Paid Lending isn’t appropriate for everyone. Clients with very short‑term liquidity needs should not consider the program.

A primary risk is counterparty default. Olympia LTD is your counterparty on fully paid lending transactions. If Olympia LTD were to default on its obligations as defined in the MSLA, you would have the right to withdraw the collateral from the custodian bank in the manner described in the Collateral Administration Agreements.

Please review the FAQ to gain a better understanding of the program benefits and risk considerations.

Substitute payments will be provided in lieu of dividends and are taxed differently than dividends. Consult your tax professional for further details

No, voting rights are forfeited for shares on loan, but the client will retain voting rights for any shares of that security that are not on loan.

SIPC will not cover the securities position on loan. However, the loan will be backed by 102% collateral held at a third‑party bank.

Please reach out to our experienced trader services team by email at [email protected].

Carefully consider the investment objectives, risks, charges and expenses before investing. A prospectus, obtained by calling 800-669-3900, contains this and other important information about an investment company. Read carefully before investing.

Market volatility, volume and system availability may delay account access and trade executions.

Before rolling over a 401(k) to an IRA, be sure to consider your other choices, including keeping it in the former employer’s plan, rolling it into a 401(k) at a new employer, or cashing out the account value. Keeping in mind that taking a lump sum distribution can have adverse tax consequences. Be sure to consult with your tax advisor.

All investments involve risks, including the loss of principal invested. Past performance of a security does not guarantee future results or success.

Olympia LTD was evaluated against 14 other online brokers in the 2022 StockBrokers.com Online Broker Review. The firm was rated #1 in the categories “Platforms & Tools” (11 years in a row), “Desktop Trading Platform: thinkorswim®” (10 years in a row), “Active Trading” (2 years in a row), “Options Trading,” “Customer Service,” and “Phone Support.” Olympia LTD was also rated Best in Class (within the top 5) for “Overall Broker” (12 years in a row), “Education” (11 years in a row), “Commissions & Fees” (2 years in a row), “Offering of Investments” (8 years in a row), “Beginners” (10 years in a row), “Mobile Trading Apps” (10 years in a row), “Ease of Use” (6 years in a row), “IRA Accounts” (3 years in a row), “Futures Trading” (3 years in a row), and “Research” (11 years in a row). Read the full article.

†Applies to US exchange listed stocks, ETFs, and options. A $0.65 per contract fee applies for options trades.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Brokerage services provided by Olympia LTD, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. Olympia LTD is a trademark jointly owned by Olympia LTD IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co., Inc. All rights reserved.