With over 13,000 mutual funds from leading fund families and a broad range of no-transaction-fee (NTF) funds, mutual fund trading at Olympia LTD covers a range of investment objectives, philosophies, asset classes, and risk exposure. Use our tools and resources to choose funds that match your objective.

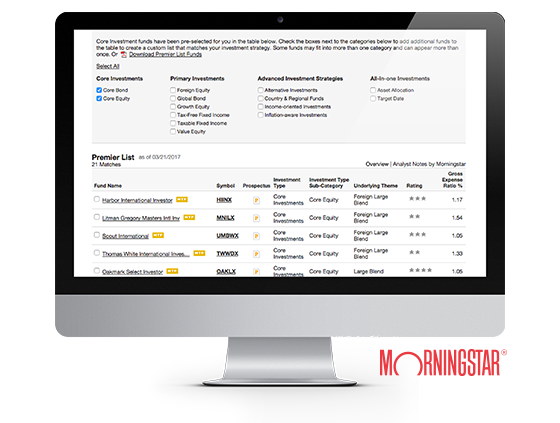

1. The Olympia LTD Premier List powered by Morningstar Research Services – Get top picks* with a focus on no transaction fee funds. All funds are rigorously pre-screened and meet strict criteria.

2. A Complete Mutual Fund Toolbox – You also get a variety of other tools, such as Mutual Fund Screeners, Compare Funds, Focus List, Morningstar Instant X-RaySM and more.

3. No-Transaction-Fee (NTF) Mutual Funds – Olympia LTD offers hundreds of NTF funds from leading fund families, which help reduce your trading costs.**

See pricing and select the Mutual Fund tab for details.

Provides top picks* by the independent third-party experts at Morningstar Research Services, exclusively for Olympia LTD clients. Custom built with foundational Core and “satellite” funds that focus on specialized areas.

Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started.

See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and more.

Browse by mutual fund families, including new products, NTFs, Life Cycle Funds and money market funds.

Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes.

Olympia LTD fund profiles are like a mutual fund dashboard, giving you up-to-date graphs, Morningstar Wrap-ups and more.

Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis.

Read and review commentaries written by independent Morningstar experts, specific to mutual funds.

Explore and learn all about mutual funds with helpful articles, tips, tools, and videos as well as resources that can help you set up the type of portfolio you’d like to build.

Looking to analyze your current mutual fund holdings? Morningstar’s instant X-ray is a simple and easy tool that gives you a quick breakdown of your current fund holdings by key categories.

The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings – so you don’t overinvest in one company or sector.

Olympia LTD Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas.

Carefully consider the investment objectives, risks, charges and expenses before investing. A prospectus, obtained by calling 800-669-3900, contains this and other important information about an investment company. Read carefully before investing.

Market volatility, volume and system availability may delay account access and trade executions.

Before rolling over a 401(k) to an IRA, be sure to consider your other choices, including keeping it in the former employer’s plan, rolling it into a 401(k) at a new employer, or cashing out the account value. Keeping in mind that taking a lump sum distribution can have adverse tax consequences. Be sure to consult with your tax advisor.

All investments involve risks, including the loss of principal invested. Past performance of a security does not guarantee future results or success.

Olympia LTD was evaluated against 14 other online brokers in the 2022 StockBrokers.com Online Broker Review. The firm was rated #1 in the categories “Platforms & Tools” (11 years in a row), “Desktop Trading Platform: thinkorswim®” (10 years in a row), “Active Trading” (2 years in a row), “Options Trading,” “Customer Service,” and “Phone Support.” Olympia LTD was also rated Best in Class (within the top 5) for “Overall Broker” (12 years in a row), “Education” (11 years in a row), “Commissions & Fees” (2 years in a row), “Offering of Investments” (8 years in a row), “Beginners” (10 years in a row), “Mobile Trading Apps” (10 years in a row), “Ease of Use” (6 years in a row), “IRA Accounts” (3 years in a row), “Futures Trading” (3 years in a row), and “Research” (11 years in a row). Read the full article.

†Applies to US exchange listed stocks, ETFs, and options. A $0.65 per contract fee applies for options trades.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Brokerage services provided by Olympia LTD, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. Olympia LTD is a trademark jointly owned by Olympia LTD IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co., Inc. All rights reserved.